Force-Placed Flood Insurance: Timing, Monitoring & Documenting

On-Demand Webinar

StreamedMay 12, 2025Duration90 minutes

- Unlimited & shareable access starting two business days after live stream

- Available on desktop, mobile & tablet devices 24/7

- Take-away toolkit

- Ability to download webinar video

- Presenter's contact info for questions

Do you understand the multitude of details surrounding force-placed flood insurance?

They include placement timing

requirements, proper notices, calculating the amount of insurance (or refunds),

documentation, reading FEMA maps, and more. Examiners are increasingly citing

flood violations, so it’s imperative that handling these issues becomes second

nature. Join this webinar to learn best practices and get a bevy of useful

tools.

AFTER THIS

WEBINAR YOU’LL BE ABLE TO:

- Explain force-placement timing requirements

- Properly prepare a notice of underinsured or uninsured flood insurance coverage

- Realize the amount of force-placed flood insurance is dependent on how the borrower will be charged for the premium and the loan contract

- Identify documentation necessary to demonstrate evidence of flood insurance coverage in connection with a lender’s refund of force-placed premiums

- Calculate the refunds for duplicate flood insurance coverage

- Recognize examiner-identified force-placement exceptions

- Explain the action steps required when a FEMA map changes a loan into a SFHA

WEBINAR DETAILS

Examiner-cited flood violations are increasing. Issues

most often arise when flood coverage lapses, and a financial institution is

required to force-place coverage. This session will address best practices for

monitoring and ensuring your portfolio has proper flood insurance coverage in

place. It will detail when the required borrower notices must be sent, when to place

coverage, and when and how the borrower can be charged for force-placed

insurance. This webinar will dive deep into the flood rules and FAQs.

WHO SHOULD ATTEND?

This informative session

is designed for loan operations personnel, compliance officers, and anyone

responsible for tracking and placing flood insurance at your institution.

TAKE-AWAY TOOLKIT

- Sample force-placed flood insurance procedures

- Sample notice of insufficient flood insurance coverage

- Force-placement transactional review checklist

- Flood insurance tracking log

- Employee training log

- Interactive quiz

- PDF of slides and speaker’s contact info for follow-up questions

- Attendance certificate provided to self-report CE credits

NOTE: All materials are subject to copyright. Transmission, retransmission,

or republishing of any webinar to other institutions or those not employed by

your institution is prohibited. Print materials may be copied for eligible

participants only.

Presented By

Brode Consulting Services, Inc.

Other Webinars That Might Interest You

Deposit Compliance Deep Dive: Beyond the Basics of Reg CC, Reg DD, Reg E, UDAAP & More

by Dawn Kincaid

Overdraft Litigation: Trends & Accepted Procedures

by Shelli Clarkston

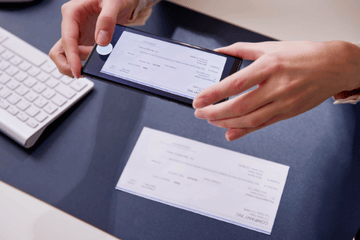

Remote Deposit Capture 360: Efficiencies & Management

by Kari Kronberg

Beginning Collector: What to Know on Day 1 & Beyond

by David A. Reed

2025 HMDA Submission Due March 1, 2026: Updates, Challenges & Real-Life Examples

by Susan Costonis

Writing Effective Credit Memos & Loan Narratives

by Molly Stull

TRID: Auditing the LE & CD for Compliance

by Molly Stull

CFPB’s Rescinded Guidance: Deposit & Operations Implications

by Deborah L. Crawford

Enhancing Videoconference Compliance & Communication for Financial Institutions

by Nancy Flynn

Flood: Auditing for FDPA Compliance

by Molly Stull

© 2026 FINANCIAL EDUCATION & DEVELOPMENT, INC