Remote Deposit Capture 360: Efficiencies & Management

On-Demand Webinar

StreamedSep 9, 2025Duration90 minutes

- Unlimited & shareable access starting two business days after live stream

- Available on desktop, mobile & tablet devices 24/7

- Take-away toolkit

- Ability to download webinar video

- Presenter's contact info for questions

Join us to learn about common fraud schemes targeting RDC and effective prevention strategies.

With this webinar, you’ll be

able to ensure operational efficiency, understand the latest regulations

governing remote deposit capture, and how to maintain compliance.

AFTER THIS

WEBINAR YOU’LL BE ABLE TO:

- Identify and mitigate fraud risks

- Optimize RDC processes, minimize errors, and enhance accountholder satisfaction

- Stay compliant with regulatory requirements

- Assess the risks involved in offering RDC to your accountholders

- Recognize the use cases for RDC indemnity claims

This course is eligible for 1.8 AAP/APRP credits

WEBINAR DETAILS

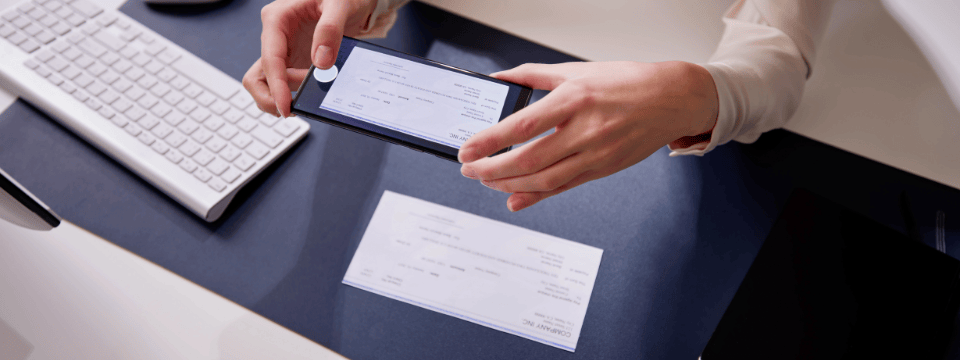

Remote deposit capture (RDC) has become a

ubiquitous feature of modern banking, offering convenience and efficiency to

both financial institutions and their accountholders. However, with this growth

comes a heightened need for robust risk management and compliance measures.

Join this informative webinar which will delve into the key risks associated

with RDC, including fraud, operational challenges, and regulatory compliance.

WHO SHOULD ATTEND?

This informative session

is intended for compliance and operations staff, particularly those who work

with RDC products.

TAKE-AWAY TOOLKIT

- Risk mitigation and sound business practices quick reference list

- Employee training log

- Interactive quiz

- PDF of slides and speaker’s contact info for follow-up questions

- Attendance certificate provided to self-report CE credits

NOTE: All materials are subject to copyright. Transmission, retransmission,

or republishing of any webinar to other institutions or those not employed by

your institution is prohibited. Print materials may be copied for eligible

participants only.

Presented By

PaymentsFirst

Other Webinars That Might Interest You

Force-Placed Flood Insurance: Timing, Monitoring & Documenting

by Dawn Kincaid

A to Z on Endorsements

by Deborah L. Crawford

Mastercard Debit Card Chargebacks: Rules, Rights & Challenges

by Diana Kern

When a Borrower Dies: Next Steps

by Shelli Clarkston

Open Banking, Banking as a Service & Lessons from Recent Enforcement Actions

by Shelli Clarkston

Are You Liable? Forgeries, Remotely Created/Deposited Items, Fraudulent ACH, Unauthorized Electronic Withdrawals & More

by Shelli Clarkston

Identifying ACH Third-Party Senders

by Jessica Lelii

Deposit Reg Series

Account Opening Series: Opening UTMAs: Lessons Learned

by Deborah L. Crawford

Creating a Seamless Accountholder Experience: Culture, Service, Retention

by Tim Tivis

© 2026 FINANCIAL EDUCATION & DEVELOPMENT, INC