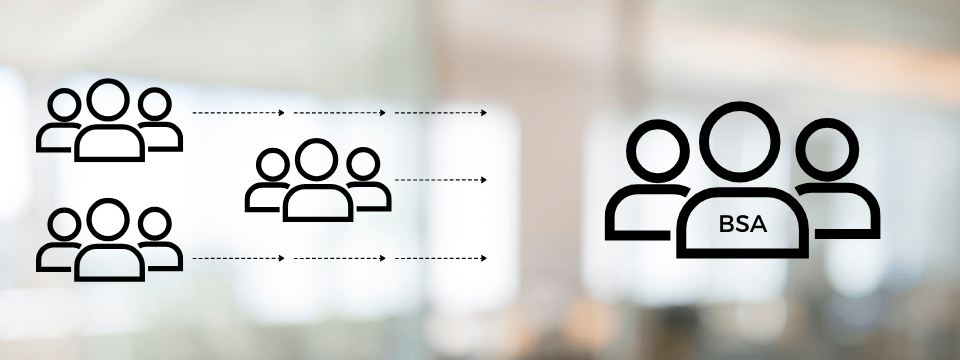

BSA Referrals: From Business Lines to the BSA Dept.

On-Demand Webinar

StreamedOct 17, 2025Duration90 minutes

- Unlimited & shareable access starting two business days after live stream

- Available on desktop, mobile & tablet devices 24/7

- Take-away toolkit

- Ability to download webinar video

- Presenter's contact info for questions

Where do BSA referrals come from?

According to the FFIEC, they

should be coming from all business lines, including lending, operations,

branches, etc. Do you have such a process in place? This insightful webinar

will cover how to develop referral forms that include red flags from FinCEN.

Now is the time to encourage your whole team to join forces to combat red flags

and make the necessary BSA referrals.

AFTER THIS

WEBINAR YOU’LL BE ABLE TO:

- Develop red flag referral forms for many of your business lines

- Encourage referrals by developing conversations with staff that explain this important role

- Dissect red flags in advisories and guidances to help develop the referral process

- Engage staff with an understanding of what each person’s role is in each department

- Identify for staff the conversations that may cause problems

- Build a great BSA referral system that will impress examiners

WEBINAR DETAILS

The FFIEC’s BSA/AML Examination Manual recommends

referral submissions from all business lines. Do you have that process in

place? Are you receiving referrals from branch staff and the mortgage, lending,

and operations departments? If not, why not? In this webinar, you’ll learn to

develop referral forms for many business lines based on the red flags FinCEN

has provided. Talk to your staff. Update them on their responsibilities for

reporting suspicious transactions. Begin to work as an organization to filter

out financial crimes of all types and calibers.

WHO SHOULD ATTEND?

This informative session

is for BSA officers, BSA staff, trainers, compliance personnel, and branch and

loan administration professionals.

TAKE-AWAY TOOLKIT

- Referral forms for mortgages, branch staff, elder financial exploitation, and more

- Employee training log

- Interactive quiz

- PDF of slides and speaker’s contact info for follow-up questions

- Attendance certificate provided to self-report CE credits

NOTE: All materials are subject to copyright. Transmission, retransmission,

or republishing of any webinar to other institutions or those not employed by

your institution is prohibited. Print materials may be copied for eligible

participants only.

Presented By

Gettechnical Inc.

Other Webinars That Might Interest You

Job-Specific BSA Training for Operations Staff

by Dawn Kincaid

Top 20 TRID Issues & Risks

by Carl Pry

Marijuana Update: On-Boarding, Payments, Monitoring & Schedule III Change Implications

by Deborah L. Crawford

Real-Time Payments (RTP) Unveiled

by Jessica Lelii

Frontline Series

Responding to Subpoenas, Garnishments & Levies

by David A. Reed

UPDATED Financial Industry Essentials Module 2: Consumer Accounts: Deposits, Loans & Account Ownership

by Dawn Kincaid

Ways to Optimize & Maximize Your Website

by Eric C. Cook

BSA & Beneficial Ownership Update for Your Business Customers

by Deborah L. Crawford

Responding to Elder Exploitation in Real Time: Delaying, Denying & Escalating Transactions

by David A. Reed

© 2026 FINANCIAL EDUCATION & DEVELOPMENT, INC