Avoiding Liability Under the Bank Secrecy Act

On-Demand Webinar

StreamedMay 30, 2024Duration90 minutes

- Unlimited & shareable access starting two business days after live stream

- Available on desktop, mobile & tablet devices 24/7

- Take-away toolkit

- Ability to download webinar video

- Presenter's contact info for questions

Don't fool yourself into thinking that civil money penalties are the only remedy available for BSA enforcement.

Recent enforcement actions have

shown that regulators are more than willing to use the criminal justice system

and its penalties against individuals to prosecute significant violations. A

regular review of enforcement actions by FinCEN should be all it takes to

remind you of the increasing perils of an ineffective BSA program. Is your

program examiner-ready?

AFTER THIS

WEBINAR YOU’LL BE ABLE TO:

- Appreciate current trends in BSA examination strategies

- Understand the array of BSA enforcement tools

- Effectively utilize regulatory and examination guidance

- Evaluate recent enforcement actions

- Deploy five lessons learned that can keep you out of jail

WEBINAR DETAILS

Now is not the time to be complacent about Bank

Secrecy Act training! Not long ago a major national bank was assessed a

$390,000,000 civil money penalty for BSA violations because of their failure to

implement and maintain an effective anti-money laundering program. Are you sure

your program and personnel are up to the task? The BSA continues to be a high

regulatory examination target and one that should receive your full time and

attention.

Join veteran compliance attorney and former BSA compliance officer

David Reed as he guides you through the tools regulators and law enforcement

can use to mandate BSA compliance. This program will address recent trends in enforcement

actions and focus on methods to ensure your staff and institution remain fully

compliant and out of the headlines.

WHO SHOULD ATTEND?

This informative session

is designed for BSA officers, senior executives, directors, audit committee members,

compliance staff, audit staff, security officers, and anyone involved with the

BSA program.

TAKE-AWAY TOOLKIT

- BSA compliance checklist

- BSA resource guide

- Key regulatory guidance

- Examination guidance

- Employee training log

- Interactive quiz

- PDF of slides and speaker’s contact info for follow-up questions

- Attendance certificate provided to self-report CE credits

NOTE: All materials are subject to copyright. Transmission, retransmission,

or republishing of any webinar to other institutions or those not employed by

your institution is prohibited. Print materials may be copied for eligible

participants only.

Presented By

Reed & Jolly, PLLC

Other Webinars That Might Interest You

When Loans Change: Handling Refinancings & Modifications

by Carl Pry

When a Borrower Dies: Next Steps

by Shelli Clarkston

2026 Agricultural Lending Challenges: Economic Conditions, Managing Troubled Borrowers & Updates on the ACRE Act & Government Support Payments

by Robert L. Viering

Troubled Loan Modifications: Evaluation, Tracking & Reporting

by Stephen J.M. Schiltz

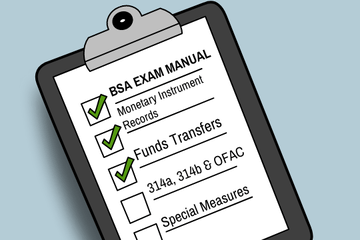

BSA Exam Manual Series: Monetary Instrument Records, Funds Transfers, 314a, 314b & OFAC & Special Measures

by Deborah L. Crawford

Business Writing Boot Camp, Including Critique of Your Own Writing Sample

by Nancy Flynn

Managing Third-Party Collection Agencies

by David A. Reed

Consumer Real Estate Appraisal Reviews: Do You Know What to Look For?

by Dawn Kincaid

Commercial Lending: Risks, Rewards, Controls & Common Mistakes

by Jeffery W. Johnson

Annual Anti-Harassment Training

by Diane Reed

© 2026 FINANCIAL EDUCATION & DEVELOPMENT, INC