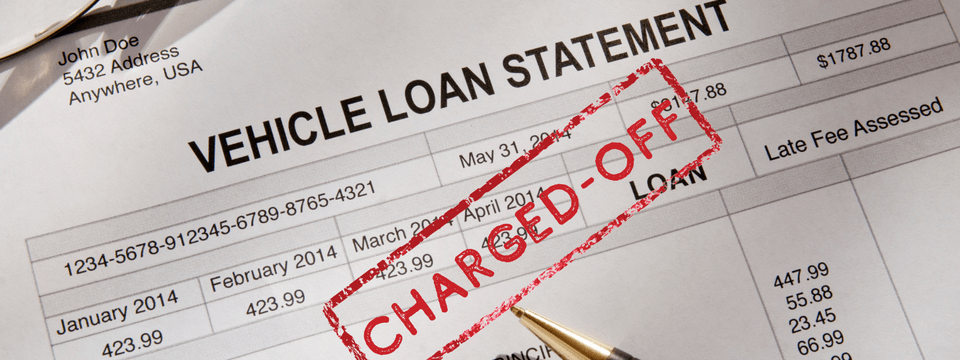

Maximizing Recoveries on Charged-Off Loans

On-Demand Webinar

StreamedApr 4, 2024Duration90 minutes

- Unlimited & shareable access starting two business days after live stream

- Available on desktop, mobile & tablet devices 24/7

- Take-away toolkit

- Ability to download webinar video

- Presenter's contact info for questions

Just because a loan has been declared a loss internally (charged off) doesn’t mean you should expect zero recovery!

These loans may not be as

“worthless” as they seem. Join veteran collections attorney David Reed as he

reveals lessons learned from over 30 years of collections and bankruptcy

experience. Now is not the time to maintain the status quo in the collections

department! Join this session to learn all you can about actual, feasible charge-off

recovery.

AFTER THIS

WEBINAR YOU’LL BE ABLE TO:

- Maximize the timing of charge off

- Evaluate in-house versus third-party collections solutions

- Choose the best placement option – agency or law firm

- Track recoveries on charged-off loans

- Understand the impact of statute of limitations

- Utilize account recall and re-placement options

WEBINAR DETAILS

News

on the delinquency front is not good. Increased late payments in credit cards

and auto loans approaching decade-long highs, combined with the restart of

student loan payments, have put pressure on your balance sheet. Are you ready

for the increased charge-off volume and confident you are getting the most from

the backend of your loan portfolio? “Out of sight, out of mind” shouldn’t

describe your charged-off loans. Just because you declare a loan loss

internally, doesn’t mean there should be zero recovery.

With an active

combination of in-house effort, collection agencies, and law firms, there are

many ways to find money in those “worthless” loans. All you need is a plan and

the ability to manage it. This webinar will give you both! From the timing of

charge-off, to effective third-party placement details, to the science of

tracking and comparing recovery results, this webinar will explore the

practical side of charge-off recovery.

WHO SHOULD ATTEND?

This informative session

is designed for executives, CFOs, lending managers, collections managers,

collections staff, and anyone interested in maximizing returns from charged-off

loans.

TAKE-AWAY TOOLKIT

- Account placement worksheet

- Lifecycle of a charged-off loan

- Regulatory guidance

- Employee training log

- Interactive quiz

- PDF of slides and speaker’s contact info for follow-up questions

- Attendance certificate provided to self-report CE credits

NOTE: All materials are subject to copyright. Transmission, retransmission,

or republishing of any webinar to other institutions or those not employed by

your institution is prohibited. Print materials may be copied for eligible

participants only.

Presented By

Reed & Jolly, PLLC

Other Webinars That Might Interest You

Right of Rescission Deep Dive: Tips & Tripwires

by Carl Pry

Loan Documentation for All Legal Entities

by Shelli Clarkston

When a Business Owner Dies, Sells, or Delegates Authority

by Shelli Clarkston

Preparation, Risk & Critical Robbery Training

by Barry Thompson

UPDATED Financial Industry Essentials Module 10: Sales & Service

by Dawn Kincaid

Annual MLO Training & SAFE Act Compliance

by Susan Costonis

Building a Successful Cross-Selling Platform

by Tim Tivis

Top 20 TRID Issues & Risks

by Carl Pry

Advanced Collection Concepts

by David A. Reed

Auditing Consumer Real Estate Files

by Dawn Kincaid

© 2026 FINANCIAL EDUCATION & DEVELOPMENT, INC